Call us Today: (845) 538-0687

A loss is the injury or damage sustained by the insured (the policyholder) because of one or more of the accidents or misfortunes against which the insurance company has agreed to pay the policyholder. Insurance contracts are designed to return you to your financial position prior to sustaining a loss of value to property you have insured. That’s the quick definition of the term indemnification.

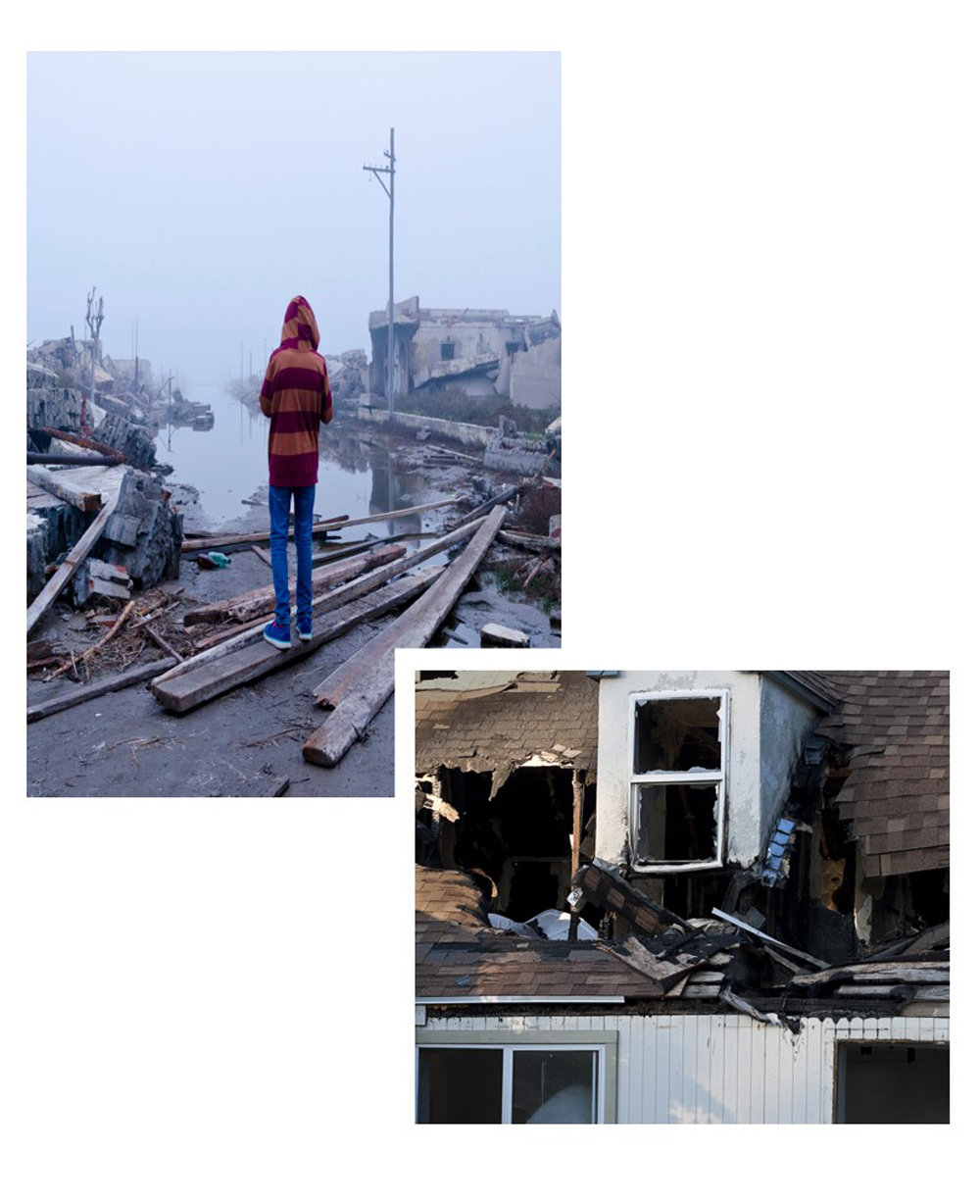

Not all catastrophes are natural disasters. Any loss of value or damage to your property can potentially cause catastrophic financial burdens. For example, you’ve had a fire in your home, a cold spell has caused a pipe to burst, your house has water damage from a leak, a windstorm has damaged your roof, a tree has struck your home causing damage, a hurricane has caused widespread catastrophic damage. All of these can result in financial loss and can be covered by insurance.

Our Commitment to our Valued Clients

- We are committed to being fair and impartial.

- We guarantee to make our decision based only on the facts presented and not to let bias affect our decisions.

- Our process is centered around reviewing and addressing all pertinent facts.

- We offer a professional assessment without considering pleasing any particular party, but to award the fair value of the claim.

- We will produce a written report or estimate for any property damages that distinguishes between Replacement Cost Value, Actual Cash Value and delineates lines of coverage.